07/04/2022

Ukraine- what is the future?

7 April 2022

The media is trumpeting how successful the doughty Ukrainians have been against the Russian aggressors, and the war crimes of the Russians assassinating civilians and destroying civilian facilities. There has been a lot of discussion about Russia’s lack of success; Putin’s surrounding himself by Yes-men and getting wrong information or having political insecurity or mental health problems. This is all somewhat hopeful. Russia is still immensely more powerful than the Ukraine and is likely to get control of the skies, which will give them an even greater advantage.

The West seemed surprised initially by the Russian invasion as they had assumed that if everyone was involved in trade and had increasing national incomes that there would be no war. Since 2000 Russia’s per capita income had risen much more rapidly than the European average since they had increased their fossil fuel exports.

The Social Democrats in Germany had been happy to buy Russian gas on the assumption of trade guaranteeing peace. Germany was also building the Nordstream gas pipeline under the Baltic Sea to make it easier to get Russian gas. Currently Europe overall gets 40% of its gas, 27% of its oil and 46% of its coal from Russia.

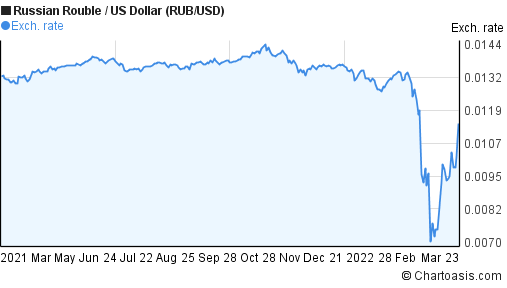

After the invasion, the West initially started sanctions in a very unified effort. The rouble fell dramatically from about 13 US cents to 7, but as European countries continued to buy the gas the Russian economy was seen to be less damaged. So the rouble has recovered to about 11, either because the Russian economy is holding up due to the continued income, or that peace is likely to be negotiated soon. Sadly, the former explanation is more likely.

Europe will take some time to make the infrastructure changes to replace Russian gas with liquefied US gas, as the methane gas has to be frozen to minus 160 degrees at atmospheric pressure before it liquefies (or minus 83 at 45 atmospheres of pressure) and then transported by ship at high pressure to ports that can distribute it. Europe currently takes 120 Billion cubic metres (Bcm) of Russian gas. Also production cannot be ramped up quickly. The US has said that it can produce and extra 15 Bcm by the end of the year and 50 by 2030. Australia and Qatar, the other big exporters do not have much uncontracted gas. Environmental limits on fracking have stopped Australia increasing production. Germany has cut its dependence on Russian gas from 55% to 40%, but major cuts would do a lot of harm to their economy. (SMH 28/3/22)

Russia will also try either to get control of Ukraine or to get some part of it, or demonstrate its power in other ways so that it can claim victory. There is a small eastern area of Moldova with a Russian separatist movement and there is a temptation for Russia to link them to Crimea by capturing Odessa and the Baltic coast of Ukraine. The idea that they are defeated may be very premature.

Here is a graph of the Rouble v. US dollar, which shows the Russian currency has largely recovered.

It is interesting that a recent (UK) Telegraph column by Ben Marlow quoted in the SMH 5/4/22 urges stronger sanctions are needed if they are to be successful.

Opinion

The West must wage total economic war against Putin

By Ben Marlow

April 4, 2022 — 11.02am

Russia’s pledge to reduce military activity around Kyiv, as part of what it calls “de-escalation”, has rightly been met with scepticism in the West, though sadly not nearly enough.

The move has prompted talk at the highest levels about whether sanctions should be lifted if Russia retreats and commits to peace. The possibility of sanctions removal was first raised by Antony Blinken, US secretary of state, a fortnight ago, on the basis that Vladimir Putin agreed to an “irreversible” withdrawal from Ukraine.

Then in an interview last weekend, Britain’s foreign secretary Liz Truss said the West could relent if Moscow withdraws and commits to “no further aggression”. This is naive in the extreme and suggests America, Europe and Britain have learnt nothing about Russia’s psychotic regime. Have they forgotten what two decades of appeasement achieved?

Putin played the West for fools right up until the invasion. Even now, Emmanuel Macron continues to pander to Russia’s warmongering leader with zero to show for nearly 20 phone conversations and a little tête-à-tête in Moscow.

Indeed there is a strong argument for doing the opposite – instead of lifting sanctions, the international community should be preparing to hit the Kremlin with a new round of even more punishing measures, not least because the current ones are clearly losing their effectiveness.

The sanctions that were imposed on Russia at the end of February were unlike anything seen before in terms of speed, scale and Western collaboration. But they certainly couldn’t be called exhaustive and the impact has clearly waned.

The Russian economy has not been crushed despite all the excitable predictions from analysts and commentators. It suffered something akin to a financial heart attack and though a full recovery will take some time, it hasn’t proved fatal and there are signs it is already on the mend thanks to the decisive action of highly regarded central bank governor, Elvira Nabiullina.

The Russian stock market has reopened after a month-long deep freeze.

A temporary stop on equity sales by non-residents, along with a short-selling ban and a short trading window, was introduced. Although there are obviously questions about how sustainable such interventionary measures are, a crash was averted.

Russia’s banking system has stabilised. Measures such as capital controls and freezes on foreign exchange deposits have helped to prevent a run on the country’s banks.

The West needs to leap into action, pressing home its advantage with a new round of sanctions that completely devastate the Russian economy, starting with a full energy embargo. Without that sanctions will ultimately fail.

Helped by a doubling of interest rates and a ban on residents transferring money out of Russia, the rouble has staged a strong rally. After slumping as much as 33 per cent against the US dollar the day after Russia’s invasion, it is now close to pre-war levels of 85 to the dollar. It might have been a nice soundbite but the rouble has not been “turned to rubble” as Joe Biden declared last week in Poland.

Much of the recovery is artificial but as long as oil and gas receipts continue to flood into the country, Russia can keep rebuilding its hard currency reserves and weather the storm.

“Self-sanctioning” in the shipping industry has been a resounding failure. Oil tankers continue to arrive in Russian ports. Traffic in March has been only slightly lower than it was a year ago, and is higher than it was during the same month in 2016 and 2015, according to research from the Institute for International Finance. Even when the discount on Russian crude is factored in, oil revenues are near record levels, the IIF says.

That’s not to say that sanctions have been toothless. Goldman Sachs is forecasting a 10 per cent downturn in Russia this year, while Barclays predicts a 12.4 per cent slump. But while Barclays expects another 3.5 per cent decline in 2023, Goldman thinks growth will have returned already with GDP expanding by 2.4 per cent and has pencilled in a record current account surplus of $US200 billion by the end of the year.

The West needs to leap into action, pressing home its advantage with a new round of sanctions that completely devastate the Russian economy, starting with a full energy embargo. Without that sanctions will ultimately fail.

Germany could withstand the shock. Robert Habeck, its own economic minister, has admitted that it would at least be able to make it through the summer. It is just too afraid to inflict further hardship on the German people, but if Lithuania and Poland are prepared to then why shouldn’t Europe’s biggest economy? They are even more dependent on the Kremlin’s oil and gas.

It may not come to that, of course, if Putin follows through with a threat to turn off the taps because the West refuses to meet Russian demands to pay for gas in roubles.

There also needs to be a widening of the ban on Russian banks using the Swift payments system. Just seven have been cut off from using it, and of the five biggest, Sberbank is the only one that has been shut out.

What else can be done? Wally Adeyemo, the US deputy Treasury secretary, has talked about additional export controls – some experts advocate for a full commodities ban or at least a broader raw materials embargo – and Volodymyr Zelensky has called for a trade and shipping blockade, something Adeyemo has refused to rule out. There should also be punishment for Western companies that continue to do business in Russia.

But as things stand, if the price Putin was meant to pay for his invasion was the crippling of Russia’s economy, then sanctions have undoubtedly failed.

Telegraph, London