22/01/2021

Submission to Senate Inquiry into Newstart 29/9/2019

Introduction

This submission addresses the Terms of Reference in order. It is written from practical experience, economic knowledge and with some research. Areas in which the author does not have expertise are not mentioned. This does not mean that they are unimportant. Comments on policy are made in relation to the term of reference, even if they are not directly asked in that term.

- An Acceptable Standard of Living including housing.

Two of the Four Freedoms in the UN Declaration of Human Rights are Freedom from Want and Freedom from Fear. It is necessary that in Australia with a relatively high national income that people have enough money for food, shelter and some money to associated with others and enjoy some quality of life. The amount of money needed for this last depends to a considerable extent on how much society’s resources are free, such as parks and health care, how much they cost such as transport, and this to some extent depends on the extent to which monopoly products, such as roads have been privatised.

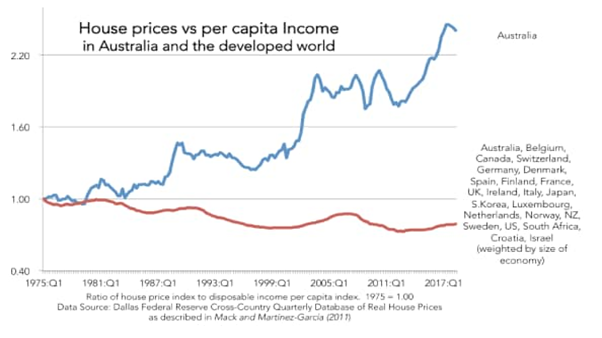

The most critical item is usually accommodation. The widespread use of negatively geared real estate as an easy route to riches for those who have surplus income has led to property being seen as an asset class that cannot lose money and almost a national Ponzi scheme where everyone buys on the assumption that prices will continue to rise. This has been self-fulfilling[i], but the national private debt has grown enormously[ii], which economists have been concentrating on public debt. The bottom line of this is that property has risen hugely in value, and in 2016 the median Sydney house price was 14 times the median income[1], but most of this value is in mortgage debt, which our banks have borrowed from foreign banks. So those who have cashed out their capital gains have done so at the expense of those who bought, and as a nation, Australia still carries the debt, requires large interest repayments, creates a national vulnerability to a fall in our dollar and limits Australia’s ability to invest in more productive assets or industries[2]. The national obsession with real estate has been worst in Australia than other countries, and this must surely relate to the negative-gearing tax legislation.

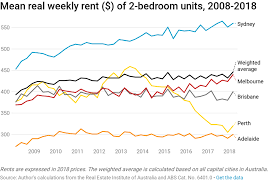

At a practical level, rents have risen as property prices rise and this has been worst in Sydney. People on fixed incomes simply cannot afford shelter, and this is compounded by the almost complete cessation of the building of public housing, which has resulted in housing stock being taken by those on welfare or with age and disability, creating a subculture of welfare dependency with few role models.

It is therefore an oversimplification to see the problems as just one of income. But to address the problem requires pro-active policies in social structures and resources as well as infrastructure and education.

Given that many landlords see their properties as an investment, they are naturally keen to maximise returns. As prices rise the rental returns fall as a percentage of capital invested, even if that capital was not invested by the landlord, but is a function of the overall market price rise. Since house prices are rising much faster than inflation, there is therefore pressure on rents to rise faster than inflation and faster than wages. Unsurprisingly, landlords and agents often encounter resistance from tenants when they try to get rent rises greater than inflation. It is therefore easier simply to terminate the tenancy and start again with ‘market rent’. This leads to tenants being forced to move every year or so, and always having to take the rent rises. This has meant that rents have been an ever-increasing share of incomes particularly in Sydney. The dislocati0on associated with forced moving is an ever-present reminder of the power structures in society and a significant demoralising factor for a considerable segment of the population.

The changes in tax so that housing investment was seen as more long-term might begin to addresses these problems, but it requires some political courage as the idea of negative gearing is embedded in the society. Property investors are aware that they are getting rich by borrowing but less aware that the selling to get rich relies on someone else’s borrowing and cannot be sustained at a nati0onal level.

- the labour market, unemployment and under-employment in Australia, including the structural causes of long term unemployment and long term reliance on Newstart;

Governments in Australia need to face the fact that there are not enough jobs for the Australians who need them and that the price structure is moving in a direction that is worsening the situation. There are a number of reasons for this:

- The use of automation to replace labour, resulting in the closure of many offices and factories

- The mobility of information, capital and goods that has allowed competition from cheap labour countries to replace Australian industries with a big competitive advantage in cost structures, so that more goods are imported.

- The weakening of unions and the rise of labour hire companies that has allowed for increasing sub award wages, cash payments and a reduction of job security.

- The use of work visas for unskilled labour, creating a sub-class of workers in the agricultural, cleaning services, hospitality and semi-skilled building industry where low wages are paid and Australian residents do not even compete for jobs.

It begs credibility that the Government is unaware of what is happening as they increase the number of unskilled workers to come to Australia on temporary visas, leave the unions emasculated and the Fair Work Tribunal under-resourced for any sort of policing role. The large number of foreign students who are in Australia as paying University fees who also need work and are a significant pool working illegally, again for cash or sub-award wages. Naturally they are in no position to complain, so act to lower real paid wages, even if they have no direct effect on statutory rewards. Australian government must face the reality that Australia’s cost and price structures are such that employers cannot compete on price in many cases and have therefore become importers. Structurally there will a continuing and probably worsening problem that many Australians will be unable to get jobs, and there needs to be a national strategy to create industries that are world competitive in a balance of payments sense and which will create lasting employment. Failing that Australia could take a Middle Eastern or Norwegian solution that charges far more royalties to companies exporting our resources and invests these in long term assets to support our economy. The development of renewable energy has been suggested as an export industry to develop, but it appears that the influence of the coal lobby is undermining innovati0on in this area. Those who chronically cannot find work remain on Newstart and the demeaning effect of continually applying for jobs that do not exist must demoralise even the most resourceful person. The ghettoization of poverty as outlined above compounds this, and it is surprising that there has been so little backlash from employers getting thousands of job application that they have no possible positions for. Presumably such correspondence is easy to ignore and dispose of.

The policy that allows ‘choice’ in schools and subsidises bus fares for children of more upwardly mobile families to attend either private schools or schools in better locations also leads to a residualisation effect where those who have less choice are all together and social disadvantage tends to be concentrated, so that there is less social help available in terms of knowledge and resources in the neighbourhood. Shortage of capital compounds this.

All this means that there are long-term structural problems in the Australian economy, which are compounded by the inequality of opportunity in the education sector. Currently this effects disadvantaged people more, so can be ignored by the more privileged classes if governments choose to ignore the long-term implications for the society as a whole. There are some in government who think that they are only there to get a larger slice of the pie for their own voter segment and that they do not have an overall responsibility for the progress of the nation. This approach must not be allowed to dominate, as a refusal to recognise the above structural issues will simply compound the difficultly as addressing them in the medium term.

Clearly those that are inappropriately trained or those who try to insist on an award wage where this has been allowed to be totally eroded, will be unable to find work and will need NewStart for a long time, particularly if there are not enough jobs.

- the changing nature of work and insecure work in Australia

The changing nature of work as noted in b. above means that many jobs are either displaced by technology or ‘offshored’ where wages are cheaper. There are also an increasing number of ‘guest workers’ on 457 Visa who are supposedly skilled and now there are provisions for unskilled workers[3] under designated area migration agreements (DAMAs). These people are supplemented by the large overseas student body who often also need work, but are legally restricted in how much or how long they can work, making them ripe for cash jobs, sub-award wages and exploitation. With foreign workers at least 10% of the workforce, and union membership plummeting, there is very little enforcement of pay and conditions. It also seems that governments want to turn a blind eye to the situation. Employers in the Northern Territory readily concede that DMA mainly are in the hospitality and tourist industries, which could presumably be done by native Australians. If native Australians are only to get ‘better jobs’ then the government which is allowing all these jobs to be taken by temporary workers ought either organise such jobs or stop blaming those in Australia who do not have jobs. It may be that if fruit pickers were paid award wages the Australian fruit could not compete in the market, but with a consumer premium on Australian product and possible action to reinforce this, it is unlikely to be the case if a real effort were made at an all of government level.

As far as the 457 visa are concerned, many of the trades coming to Australia, such as tiling, gyprocking, cement rendering, plumbing and cooking could be done by Australians, but the educational emphasis on universities and training in the medical, legal and financial areas and the deliberate neglect of TAFE, technical skills and apprenticeships has meant that Australia has a huge oversupply of wannabe CEOs and a severe shortage of tradesmen. What training our youth have is not actually appropriate for our long term needs. The two concepts of making education a for-profit exercise and letting ‘the market’ decide as if it has intrinsic wisdom, has made many young people do inappropriate training, before ‘the market’ teaches than the error of their plans. Governments may not be able to predict exact numbers of each occupation needed in the next 20 years, but they should at least make an effort. The absurd mismatch of skills needed and current training practices begs serious attention.

Employers, facing competition from imports with lower wages structures have lessened their cost by making work casual and only paying for workers when they are needed. From an employee’s point of view the casualisation of work means that they do not have stable income, which has both immediate effects and also longer term ones in that they cannot get home loans or even rental properties on that they cannot show that they will be able to meet financial commitments reliably. This further marginalises many workers and adds to social inequality.

- the appropriateness of current arrangements for supporting those experiencing insecure employment, inconsistent employment and precarious hours in the workforce

The Author does not fully understand the overall situation with regard to current arrangements but can make some observations and recount anecdotes that relate to experiences as a professional coming into contact with support systems. The author currently works as a doctor treating Workers Compensation and Motor Vehicle accident injuries, so observes the action of insurers who act as private support for these people and also Centrelink in terms of people getting NewStart or the Disability Support Pension.

It might be noted that the NSW government has made legislative changes to reduce the time that workers compensation and third party insurance are paid to 5 years and to give insurers more discreti0on to deny payments to injury victims. This was in order to be able to lessen premiums and be able to claim that the State was ‘business friendly’. The premiums have fallen and the private insurers have had a windfall, but this has been at the cost of payment to injured workers, both in terms of treatment denied and in terms of income benefits obtained. The author wrote a detailed submission to the Hayne Royal Commission re this.

The effect of this legislation has been to force people who were on compensation to seek either NewStart of the Disability Support Pension from Centrelink. I might be noted that the Workers Compensation legislation of 2012 gave long-term compensation patients another 5 years of support, but this came to an end in December 2017. Most of these patients had been on compensation for more than 5 years, despite the funded rehabilitation and job training programmes. It might be stated that his gave them a better chance of finding a job than others in the same physical condition who had not been injured at work. Nevertheless Centrelink has resisted putting many of these people on the Disability Support Pension and insists on NewStart for many people. A discontinued survey be SIRA (State Insurance Regulatory Agency of NSW) found that only 29-30% were on some sort of benefit. 8% had been declined by Centrelink, 12% were still being assessed by Centrelink, 18% had too many assets to get a benefit (and leaves 32% not mentioned)[4]. Prime Minister Morrison boasted that fewer people were being put on Disability Support Pensions, but this actually started under the Gillard Government. The author has a patient, a migrant illiterate in English, and probably his own language who was 61 years old, had been on Workers Compensation for a back injury, had Parkinson’s disease and was a carer for his sick wife and was refused a DSP. His chance of getting a job was negligible. When the doctor took some time to write a detailed report to help the man, Centrelink stated that they would not pay more than $150 for the report, which took a couple of hours to do as his medical history was very complicated. He was forced onto NewStart and given a provider and lot of literature on ‘mutual obligations’ that he was not even able to read. Attempts to call Centrelink result in waiting times on the phone of up two hours. A computer eventually answers the call and cuts the person off if they cannot give the number and its suffix (which it may not have) in a very short time. If complaints on the website are not filled in in a certain time, the site simply switches off, losing the draft complaint. The systemic arrogance and indifference shown by Centrelink to its clients has to be experienced to be believed.

The author recommends that all the Committee assessing this issue try to contact Centrelink by phone, attend an office and personally interview a few people in the situation.

- the current approach to setting income support payments in Australia

It would appear that the level of benefits is set historically and rises only when political pressure is applied to the system. There does not appear to be any logical formula setting the level of benefits in relation to costs, inflation, rents or the poverty line. If this is indeed so, it is no basis to run the welfare system of a country with systemic unemployment and the need for some degree of equity to maintain social harmony. If Australia has boom times it is fair that the success be shared, if there are bad times, it is fair that the pain also be shared and the effects of downturns not borne disproportionally by the most disadvantaged.

- the impact of the current approach to setting income support payments on older unemployed workers, families, single parents, people with disability, jobseekers, students, First Nations peoples, people from culturally and linguistically diverse backgrounds, people living in regional and remote areas, and any others affected by the process;

The author does not have quantitative data on the impact of different groups, but has anecdotal evidence of patients utterly depressed about how they were treated by Centrelink, in despair about their ability to pay their bills and expressing a lack of hope for the future and suicidal ideation. Older workers feel that they have no hope of ever getting a job. Young unemployed complain that they cannot have a life as they have no money to get to job interviews, cannot join their friends for a drink or any social activity such as a coffee or a movie. This is very destructive of their self-esteem.

- the impact of geography, age and other characteristics on the number of people receiving payments, long term unemployment and poverty;

The author works in suburban Sydney where the effects are very significant as stated above. Unemployed people have difficultly even getting to a doctor in suburban Sydney due to lack of funds and are frequently changing address as they have to couch-surf as they cannot afford rents.

- the adequacy of income support payments in Australia and whether they allow people to maintain an acceptable standard of living in line with community expectations and fulfil job search activities (where relevant) and secure employment and training

The oncome support level is quite inadequate for any sort of quality of life, and there is insufficient money even to carry out job search activities. Young people need computers, printers and stationery to write and send resumes to meet their ‘mutual obligation’ targets, and it is even difficult to get haircuts, reasonable clothes and transport to the interviews if any. The costs of mobile phones are also a significant expense. If they do not have unlimited time on their mobile phone contracts they are likely to run out of credit before Centrelink even answers the phone. If they do not have unlimited time they cannot afford to call Centrelink.

- the economic cost of long-term unemployment, underemployment, poverty, inequality and inadequate income support payments;

It is difficult to quantify the long-term costs of unemployment. The loss of self-esteem and the behavioural changes that this may create may be very destructive but are also an opportunity cost; what may have been is lost. The loss of experience means defects in a CV and those who have a current job are usually preferred over those who do not, creating a spiral of long-term unemployment as the longer the unemployment, the more likely it is to be prolonged. Eventually the long term unemployed form a subculture of demoralised and invisible people. It is somewhat surprising that there has not been more street crime with muggings such as happens in the US, when the unemployed lose all faith that society will look after them, see the average person’s indifference and therefore target random employed people. What society decrees as ‘survival of the fittest ‘in the normal economic and social framework may become a far more basic ‘survival of the fittest’ in a back alley, as happens in the USA.

- the economic benefits – including job creation, locally and nationally – of increasing and improving income support payments and supports, and decreasing poverty and inequality

It is likely that the fiscal stimulus of an increase in NewStart payments and the DSP are likely to be very beneficial . It must be noted that the governor of the Reserve Bank, Philip Lowe has called on the Federal government to provide fiscal stimulus[5] as the tax cuts and low interest rates have not been enough to increase consumer spending, which is the major engine of economic growth. It is know that poor people spend a much greater percentage of their income, in that they are not able to save. Hence money given as an increase in NewStart or the DSP is likely to have a better economic multiplier to the economy than either tax cuts or infrastructure spending as the tax cuts tends to go proportionally to higher income who have an increased propensity to save, and infrastructure spending also has corporate profits retained. The RBA has noted that long term increases in income lead to a greater propensity to spend than one-off payments[6], an unsurprising conclusion. It has been stated that poorer people spend close to 100% of extra income, and this is certainly likely to NewStart recipients, whereas wealthier people may save up to 30%, having a far lesser multiplier effect in stimulating the economy.

The social effect of raising the income of welfare recipients are likely to be a reversal of the problems detailed above in proportion to the magnitude of the increase. It will reduce inequality, give some hope to those on welfare and as such it is very important to the social cohesion in Australia.

- the relationship between income support payment levels, minimum wages and wage stagnation in Australia and other comparable economies

The level of income support needs to approach wage levels to achieve the ability of welfare recipients to have a reasonable life. Some people assume that if the unemployment benefit level approaches that of a low wage that unemployed people will not strive to get work. This assumes that work is only an economic activity. It is far more than this; it is a route to social acceptance and feeling of participation. Those who take this highly economic view of work are usually very dry and have not spoken to those who are unemployed and would benefit from doing so. There is only danger if the loss of transport and health concessions by virtue of being unemployed are lost as soon as work is started and then have a long lead time to be reinstated. One of the more callous ‘reforms’ of the Morrison government was to only pay benefits when they were granted, rather than backdated to when the application was first made. This has doubtlessly saved the government money, but people do not apply for benefit until they can demonstrate a need for them and they are able to demonstrate such need at the time that they apply. Clearly they have difficulty surviving while their claim is processed and there should not be an incentive for Centrelink to delay processing application, which is currently the situation.

It is unlikely that the level of welfare affects the level of wages. What is more important is that those who only have welfare are able to have a decent life. There are too many policy makers who mix up their private moral prejudices with evidence-based policy. This leads to assumptions that those without jobs do not want them and they must be punished for not having a job. A more cynical view is that blaming the victims encourages people not to look at the inadequacy of the elite who unable to govern for the whole of society, unable to provide enough jobs for those who need them, or even to have an honest examination of the problems in society that cause these problems. As one humane person commented, ‘There is not a shortage of jobs. Anyone could give you a laundry list of things that need to be done. There is lack of structure that will pay the people who do not have jobs to do things that need to be done’. A job as currently defined is a task that either makes a profit for the employer or the government is willing to subsidise with taxpayers funds. With government shrinking, and international and technological competition restricting industry, and government following an ideology that it must become smaller, most industries are shedding labour, even when it would be better to have it, for both the workers and the society.

- the interactions with other payments and services, including the loss of any increased payments through higher rents and costs

The cost of providing people with a basic income should not be surrounded by a paranoia that other costs may rise. It is certainly possible that a rent subsidy as an isolated measure may raise rents if it increases the resources of the renters without changing the quantity of rental stock. Presumably the only thing that would keep rents down is vacancy and people unable to pay the asking rent. So if the amount people can pay rises these properties will rise in rent. But to simply subsidise rent without a policy to provide affordable housing will inevitably have this effect. The problem is not the rent subsidy; it is the lack of provision of affordable housing.

- the cost and fiscal sustainability of any changes

The cost of increasing Newstart can be calculated. The fact that this is of comparable magnitude and is almost discussed as an option illustrates how little care the government has for the welfare of people that they are unable to provide jobs for. The price is the price of having a fair society. If this requires a bit more tax this should be raised. The permanent cutting of taxes when there is a temporary boom in commodity prices is extremely irresponsible policy, and it may have to be reversed. The achievement of a surplus at the expanse of giving poorer people the means to live says a lot about the priorities of government, the commodification of people, and how out of touch our leaders are with quite a large segment of society. If they wish to take a moral stand, one might remind them that a society should be judged by how it treats its weakest members. Pious people shod remember the story of the Good Samaritan and the questions asked, ‘Who was this man’s neighbour?’

- the relative merits of alternative investments in health, education, housing and other programs to improve outcomes;

One of the key needs is affordable housing. Without housing it is very difficult to organise a life. Currently unemployed people in Sydney have great difficulty finding accommodation and rely on friends or relatives, sharing rooms, couch surfing and moving relatively frequently. Money put into affordable housing would be money well spent, and is frankly a disgrace that housing has become an asset class for investors who build for the aspiring middle class rather than affordable housing and the government seems content merely to watch as inappropriate housing is built for much of the need. Indeed government housing is now largely confined to more and more disadvantaged groups, creating ghettos of social problems. The provision of affordable social housing should be a major priority as shelter is a major human right.

The provision of access to health is also a human right. The word ‘health’ has been appropriated and now in common political parlance refers to ‘access to insurance to pay for treatment of sickness.’ Health is actually the absence of sickness and it is far cheaper and better to maintain it than to merely pay for treatment of those already sick. Access to good food and housing are far more cost-effective than medical programmes, particularly private health insurance, which has an increasingly elective nature in terms of what is done, and the degree of luxury in which it is done. A retiring US Surgeon-General was asked ‘what was the greatest medical advance in your time?’ and to the surprise of the questioner replied, ‘The introduction of Food Stamps’. He recognised the importance of nutrition in the maintenance of health. In the US, with its niggardly attitude to welfare there are increasing problems with nutrition for r poor people and controversy over the payment for this such that there is a discussion of the need for better nutrition[7]. Australia with its poor levels of NewStart and its controversy over the cashless welfare card probably has a similar problem which is as yet not recognised. It might be noted that there was free milk at schools in former times in Australia, and more recently there is a ‘National School Lunch Program’ in the US for children in lower socioeconomic areas[8] as they recognised that students were undernourished and this was affecting their education. In terms of alternatives to raising NewStart, Australia may want to consider such programmes as it may increase equality of opportunity and school attendance in disadvantaged communities. New Zealand makes use a school nurses with a wide range of functions[9]. This may a better way of delivering welfare to areas of disadvantage, especially if parents are dysfunctional.

In terms of preventive health, as opposed to treatment programmes such as school-based dental care, vaccination, or learn to swim classes may help improve health and save lives in disadvantaged communities and improve equality of opportunity.

In terms of the cost-effectiveness of education spending, two features stand out. The first is that Australia is falling down the league tables of world school education at a serious rate and a serious level[10]. The second is that the Gonski Model of education funding has not occurred and there continues to be very high levels of subsidy to the private sector, with corresponding neglect of public school education[11]. Education is like health in that it is more important that those at the bottom get a reasonable basic standard than that those at the top get everything that can be offered. Yet the political imperatives work the other way. ‘Choice’ in education has a very detrimental effect in that subsidies, such as free travel and private school subsidies allow more privileged children to move to be with similar privileged children. There is then residualisation. All those with disadvantage are congregated together with lesser resources and a lack of role models. Clearly the poor results achieved in this situation drag Australia’s average down, as well as condemning children from disadvantaged areas to perpetuate their parents’ disadvantaged situation. Funding equality of opportunity would give these children a better start in terms of education, hopes, and employment, and as such would be an investment in reducing longer term unemployment.

It might be noted that universal health insurance is also very important. Medicare is being undermined in that the Medicare rebate to doctors, which was set at 85% of the AMA fee in order to get doctor support for the concept, has been totally undermined. The government has not raised the rebate with inflation for over 30 years, so that the real value of the Medicare rebate has declined form 85% of the AMA rate to 46%. This s an almost 50% cut from a doctor’s point of view and is a demonstration of very bad faith by successive governments. Treatment of Medicare patients has thus returned to the status of ‘charity’ in the minds of many doctors. Almost all specialists and many GPs will not take Medicare without a co-payment, so the ‘bulk-billing’ rates as trumpeted by the government are based on the GP habits, where quicker and more consultations have been used to make up the income deficit. But these bulk-billing figures also neglect to mention the fact that a co-payment exists for many services in addition to the Medicare bulk-bill. Many patients go to the Emergency Departments (EDs), rather than a GP because these are free. This tends to be discouraged by the EDs so patient present later and sicker. ED visits are far more expensive than GPs, so it is false economy to save money on GPs and to push patients to EDs. It is also a cost transfer from Federal to State payments system and the overall cost to Government is greater.

- other countries’ approaches to setting income support payments, minimum wages and awards

The level of payments depends to a considerable extent on the supply of shared or public resources. If there was universal access to affordable housing, free education, free health care and cheap public transport, income support needed would be less. Similarly if there is poor public transport, car dependency, privatised toll roads, education and health with many co-payments for doctors’ visits, school excursions and sports, more money is needed in welfare payments if there is to be any hope of equality of opportunity for children and a reasonable life for welfare-dependent adults. Yet usually these aspects of social policy are seen in isolation. Though the private sector is assumed to be highly efficient, the countries with the highest standard of living such as Denmark and Sweden often have very large public sectors. The point is that natural monopolies can deliver goods more cheaply than private organisations as they do not have to factor profits into their operations, so if both private and public systems were run with the same efficiency, the public one would be cheaper because of the lack of need to generate a profit. The need for public good also needs to be calculated. A public transport system that loses money might have huge benefits that could be costed, such as the savings o roads and parking, better air quality and making central city jobs available to people from the outer suburbs. Parents in inner city locations are familiar with problems such as difficultly staffing their child care centres as the lowly-paid staff cannot afford transport costs from the outer suburbs and either seek jobs closer to home, or do not work. Making each element in society pay its own way without looking at an overall picture of spending and benefits amounts to having policy options confined by a very simplistic accounting system.

- other bodies that set payments, minimum wages and awards in Australia

The setting of award wages in Australia has been traditionally done in the Courts which has in theory prevented political interference, but the destruction of unions by both changes in the concentration of workers and by deliberate political action has allowed the forces of both a global market and a large ununionised and unsupervised pool of temporary visa workers and students needing income has allowed the eroding of wages, particularly in the lower socioeconomic groups. This has allowed the growth of an increasing ‘cash economy’. This has created a US-style ‘working poor and underemployment, who may not be actually unemployed, but have the same problems as if they were, at times exacerbated by the lack of benefits such as a Health Care card or transport concessions that may be available to those officially on welfare. In the mid-1980s the Australian Bureau of Statistics defined ‘unemployment’ as having less than 25 hours per week of work. The US definition was that anyone with regular work, even an hour a week was ‘employed’. Commentators such as Maximilian Walsh even compared the US rate to Australia’s, concluding that Australia was doing very poorly! Political pressure soon made Australia adopt the ‘international definition’ and our unemployment rate plummeted. The calculation of index had been consistent, but the number has been relatively meaningless ever since.

- the role of independent and expert decision–making in setting payments

The principle that wage setting must be kept separate from government should be extended to unemployment relief. The politicisation of welfare, the moral judgements that go with it and the relative political powerlessness of those on welfare means that a neutral and evidence-based approach to welfare needs to be established. This may appear a radical proposition given the relatively large cost of welfare. But the danger of political interference has been recognised in having the Reserve Bank as an independent entity, and this principle is endorsed by all leading economies. The Boilermaker’s principle in law upheld the need for an independent wage arbiter. There are also pricing tribunals that set electricity prices. While it is true that a higher welfare payout may cause government inconvenience in that thy will have to budget for this, the current practice to grant tax cuts which are electorally popular, favour wealthy people and are granted when the economy is enjoying high commodity prices for exports also makes for budget pressures later[12]. It is an irony that governments concerned about the effect of welfare expenditures are the same ones that grant tax cuts, and are keen on privatisation deliberately undermining long term government revenue. An independently-determined, reasonable level of welfare would create a cost obligation that would have to be managed by future governments, but this might make them less cavalier about giving away their revenue sources and make them recognise that they must manage the country for all Australians, not merely the demographic that voted for them.

www.news.com.au/finance/economy/australian-economy/viral-graph-shows-house-price-danger/news-story/8ef84bdc2aaa5bb589aa77da5522d45b

Murphy, Jason, ‘Viral Graph shows House Price Danger’ 16 November 2018 www.news.com.au/finance/economy/australian-economy/viral-graph-shows-house-price-danger/news-story/8ef84bdc2aaa5bb5

[1] www.buildsydney.com/australian-housing-bubble/

[2] Walters, Stephen ‘The Risks in Rising Australian Household Debt’ 1 August 2018 http://aicd.companydirectors.com.au/membership/company-director-magazine/2018-back-editions/august/economist

[3] www.abc.net.au/news/2018-12-10/immigration-australia-skill-english-salary-concessions-regions/10355054

[4] NSW Parliamentary Estimate Portfolio Committee 6 Transcript of hearing 12/9/19 p 35 www.parliament.nsw.gov.au/lcdocs/transcripts/2240/Transcript – 12 September 19 – UNCORRECTED – PC 6 – Customer Service – Dominello.pdf

[5] www.afr.com/policy/economy/can-t-rely-on-monetary-policy-alone-20190702-p5239x

[6] www.rba.gov.au/publications/rdp/2009/pdf/rdp2009-07.pdf

[7] www.huffpost.com/entry/food-stamp-myths_b_1334924

[8] www.fns.usda.gov/nslp

[9] /www.nzschoolnurses.org.nz

[10] www.smh.com.au/education/un-agency-ranks-australia-39-out-of-41-countries-for-quality-education-20170615-gwrt9u.html

[11] https://insidestory.org.au/what-gonski-really-meant-and-how-thats-been-forgotten-almost-everywhere/

[12] Seccombe Mike, ‘How John Howard’s Tax Cuts undid his protégé, Tony Abbott’ The Saturday Paper 20/12/14

[i]Pash, Chris ‘Here’s a look at the widening gap between wages and house prices’ 6 March 2018 www.businessinsider.com .au/chart-australian-wages-house-prices-2018-3

[ii] www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp0809/09rp30#_Toc228933532

Kryger, Tony ‘Australia s foreign debt data and trends’ Research Paper no. 30 2008–09, 7 May 2009

Note that this graph only goes to 2011